Car dealer can be an independently owned and operated business that sells both new and used cars or can be a used car dealership. The majority of dealers also provide other facilities like, services, repairs, trading, lease, and other financing where necessary.

There are independent dealerships that may sell second-hand cars and franchises that are affiliated solely with new car makers. Sometimes, a new car dealership may handle several makes under the same ownership. In some locations, dealerships have been centralized under conglomerates that run diverse brands of automobiles.

The U.S. auto dealership market was valued at $257.30 billion in 2023 and is expected to grow to $338.59 billion by 2030, with a projected compound annual growth rate (CAGR) of 4% between 2024 and 2030.

History of the Automobile Dealership

In the early days of car manufacturing, car makers sold cars to the actual customer or through direct selling techniques like mail order selling, selling through departmental stores, selling through itinerant agents. The first automobile dealership as an exclusive business can be linked to the year 1889 whereby Fred Koller established the known Reading Automobile Company. This dealership is of Cleveland, Ohio, and was the first that specialized in automobiles instead of carriages that were in demand before. The first female car dealer was Rachel “Mommy” Krouse, who founded Krouse Motor Car Company in 1903 in Philadelphia, U.S.

The car dealership industry has declined over the years in the U. S, having reached its high in 1927 with 53,125 dealerships. By 2001 the number of dealers was reduce to 22,007. Today’s dealerships are more about brands and technology. Some have a specific image to uphold and provide consultants to assist the buyers in their car acquisition. For instance, Audi has tried hi-tech showrooms which allows one to design cars on large touch screens.

Quick Understanding of US Automotive Industry

The U.S. automotive industry was valued at USD 1,514.8 billion in 2022 and is expected to grow from USD 1,567.81 billion in 2023 to USD 2,064.51 billion by 2032, with a compound annual growth rate (CAGR) of 3.50% over the forecast period (2023–2032). This growth is largely driven by increasing demand for commercial vehicles, fueled by the expanding logistics and passenger transportation sectors. Additionally, government policies and initiatives are playing a crucial role in driving market expansion and are expected to continue influencing industry growth in the coming years.

U. S. Auto Dealership Market, By Type:

New Vehicle Dealerships: These dealerships are in the business of selling brand new automobiles that have been manufactured directly from auto makers, usually franchise dealers of certain automakers.

Used Vehicle Dealerships: These dealerships major in the buying and selling of second-hand cars that they acquire from auctions coming from other dealers, from other car owners and also from traders.

Parts and Services: This segment delivers vehicle maintenance, repair services, genuine parts of vehicles, which may be done by expert mechanics of the dealership.

Finance and Insurance (F&I): It provides customers with the facilities of credit and lease for purchasing their desired motor vehicles. It may also contain sundry insurance products for the vehicles sold.

U. S. Auto Dealership Market, By Retailer:

Franchised Retailers: Those that have entered into contracts with individual car makers and lots of following the computed images and selling rates.

Non-Franchised Retailers: Franchise dealerships that are not associated with a specific make of vehicles and can purchase and sell all kinds of used car makes.

U. S. Auto Dealership Market, By Vehicle Type:

Passenger Cars: These could be sedans, hatchbacks, SUVs, MPVs, and all those cars mainly used for commuting.

Commercial Vehicles: Hoods trucks, buses, vans, and others vehicles primarily used for carrying goods and sometimes people.

US Automotive Dealership Market Trends

The automobile sector which has been dramatically affected by COVID-19, is now experiencing growth as restrictions are eased and dealer businesses are more busy. In contrast to public transport, the huge demand for personal vehicles increases the demand for both new and used cars, thus expanding the market. Automotive manufacturers in turn, are putting much energy into enhancing the consumers’ experience and are seeking to build more dealerships to tap into this growing market.

Dealerships are essential to OEMs (Original Equipment Manufacturers) for direct sales and, perhaps more importantly, for post- sale ancillary services to the end users. Large dealership networks have been on a position to expand and have also taken their time to invest in new technologies and services, thus making them survive. For instance, the Kia 2023 Telluride SUV unveiled in November 2022 shows how the car manufacturers are trending in their application of new features to cater to the consumers’ demands of robust and versatile cars.

Also, the growth of EVs and other new auto technologies is helping to shape a more favorable future environment. The quick rise of electric mobility and technical vehicles tells a very positive story of the market, where dealers are seen to be promoting this shift recently.

Importance of Studying Geographic and Economic Trends for Automobile Industry

Studying geographic and economic trends is crucial for the automobile industry for several reasons:

1. Market Demand & Consumer Behaviour

Changes that occur on the geographic location show the areas where consumers are asking for automobiles or the areas that they are avoiding. For instance, new markets, including SE Asia or Africa, may demonstrate higher demands for simpler vehicles, while mature markets may focus on electric or premium cars. This assists a company in formulating its strategic goals and objectives of marketing its products by specializing in the areas deemed popular with people.

2. Economic Conditions

Macroeconomic factors like the growth rate, inflation, and unemployment impact consumers’ purchasing power. This means that in areas experiencing high economic growth, customers are likely to purchase new cars, whereas during risky periods, it will be difficult for them to afford to purchase new vehicles, or they may opt for leasing cars or even secondhand cars.

3. Infrastructure Development

Demands for certain types of vehicles depend on geographic factors such as road conditions, the availability and distribution of charging points, and the degree of urbanization. For instance, regions with a growing system for charging electric cars will probably have higher demand for them, while regions with poor road networks in rural areas may still require durable and off-road cars.

4. Government Regulations

Environmental standards set by governments, such as emission standards or subsidies provided to green vehicles, form the basis of demand differences across geographical regions. For instance, markets with decreed obligatory carbon emissions may record high sales of hybrid or electric cars. In contrast, markets that do not have such stringent emission standards may record high demands for fuel-powered cars.

5. Supply Chain and Production Costs

Dealer dynamics, such as the cost of labor, availability of materials, and change in currency, affect the car production and assembly model that firms adopt. Ease in access to growing parts suppliers and key markets also reduces production and delivery costs and can provide a competitive advantage.

6. Technological Advancements

The implementation of new automotive technologies, such as autonomous driving or connected cars, may significantly differ from one region to another depending on infrastructure and legal peculiarities. It allows businesses to properly enter markets with tech innovations where they will have the greatest chance of success.

Top 5 Largest Automobile Dealers in the United States in 2024

However, the automotive industry in the United States will continue to be one of the largest and most competitive markets in the globe in 2024. A vital group of players comprises automobile dealers with strong relationships with manufacturers, offering vehicles, maintenance, and many other related services. These dealerships have expanded their size and scope through acquisitions, have adopted diversified services, and have concentrated on customer satisfaction.

The five primary auto dealers operating in the U.S. markets sell new and used cars and significantly impact the direction of many automobile industry trends. Now, let’s take a closer look at the top five automobile dealers in the United States that have grown into leaders in this constantly evolving industry in 2024.

1. Husqvarna

Husqvarna currently dominates all other automakers in the U.S. dealership market with 7,955 outlets; it is the market leader in 37 out of 56 states and territories. It can be considered a market leader because it has many locations throughout the country and has wide access to a broad group of customers. Its dominance is further reinforced by its ability to operate in 3,870 cities effectively, ensuring it remains a key player in the industry with a widespread reach.

2. Tucker Powersports

Tucker Powersports comes in second place with 7,644 outlets, making it the biggest automobile dealer in 14 states and territories. Although it does not cover as vast a range as Husqvarna, Tucker Powersports has gained a substantial market niche. The company has shown excellent performance in some states, where competition increases sharply. Tucker Powersports maintains a strong presence with 3,118 outlets that cater to a diverse market segment, particularly in the powersports niche.

3. Western Powersports

Western Powersports, a prominent automobile dealer, has 6,145 locations and is the largest dealer in five states and territories. Still, unlike Husqvarna and Tucker Powersports, which perform at a larger scale, Western Powersports has successfully positioned its core products and services in the selected markets, focusing on specific niches. It operates in 3,038 cities, making it a significant competitor in the automotive and power sports dealership market.

4. Chevrolet

Chevrolet, which is associated with more conventional car manufacturing, is less generous and occupies fourth place with 2,899 stores in 53 states and territories. Chevrolet has an aggressive network presence across the domestic market with 2,271 cities; it deals especially in new and used automobiles and provides customers a diversified assortment of vehicles and services.

5. Ford

Ford, another car manufacturing company, ranks fifth with 2,874 stores across the states and territories. With 2250 outlets, Ford still actively impacts the automotive market, offering a range of car choices and reliable after-sale services to numerous customers throughout the country.

Comparison of Dealership Presence in the Top 5 U.S. States and Territories

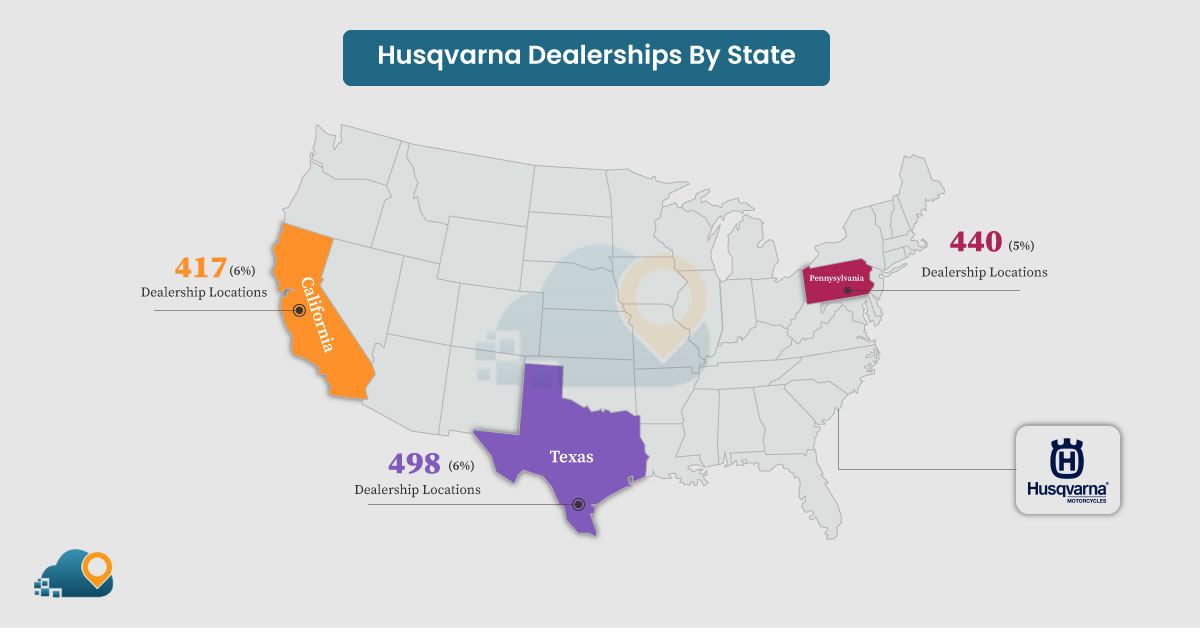

Husqvarna Dealerships By State:

Texas:

There are 498 Husqvarna dealerships in Texas, representing 6% of the total number of dealerships. This gives a population of roughly 58,225 people per dealership throughout the state.

Pennsylvania:

Presently, the company has 440 dealerships in Pennsylvania, which gives the state a 6% representation of the total number of dealerships. There is approximately one dealership for every 29,095 residents in the state.

California:

California has around 5% of the 417 total Husqvarna dealerships in the world. Another industry fact is that there is one dealership for every 94,753 people in California.

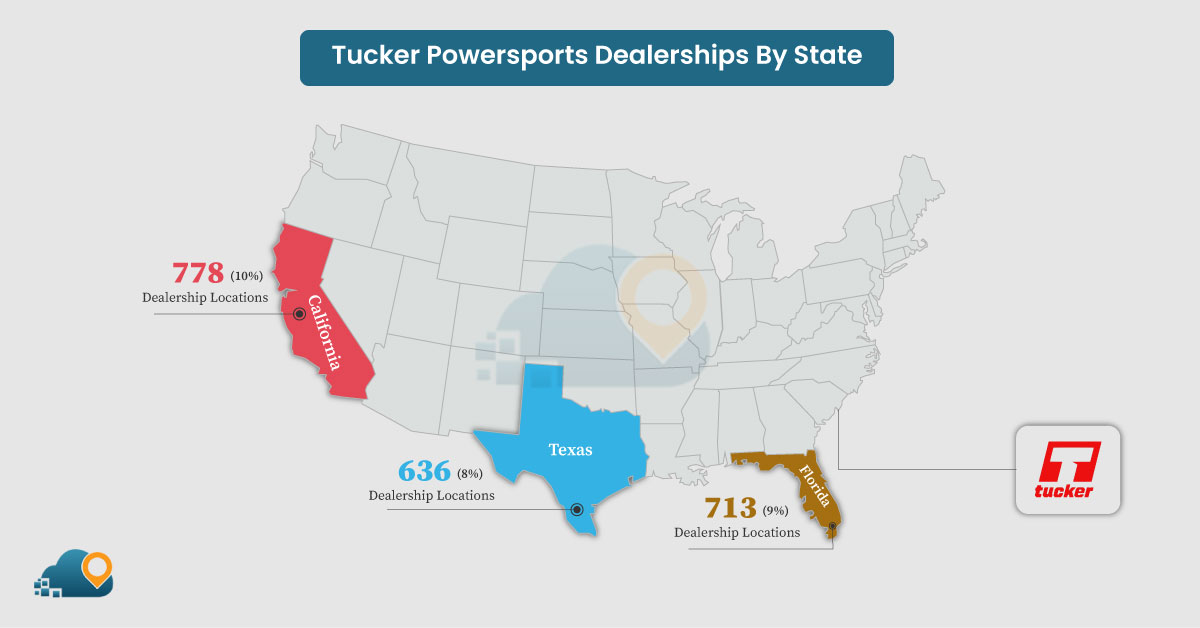

Tucker Powersports Dealerships By State:

California:

California has 778 Tucker Powersports dealerships, which is about 10% of the total number of dealerships. This is approximately one automobile dealership for every 50,787 residents in Florida.

Florida:

Florida has the second-largest concentration of Tucker Powersports dealerships, with 713 units and a share of 9% of all locations. It shows significant market penetration in Florida, with one dealership for every 30,123 people.

Texas:

Texas is home to 636 Tucker Powersports dealerships, which represent roughly 8% of these outlets. This equates to one dealership for every 45,591 people in the state, indicating a significant distribution across a large population.

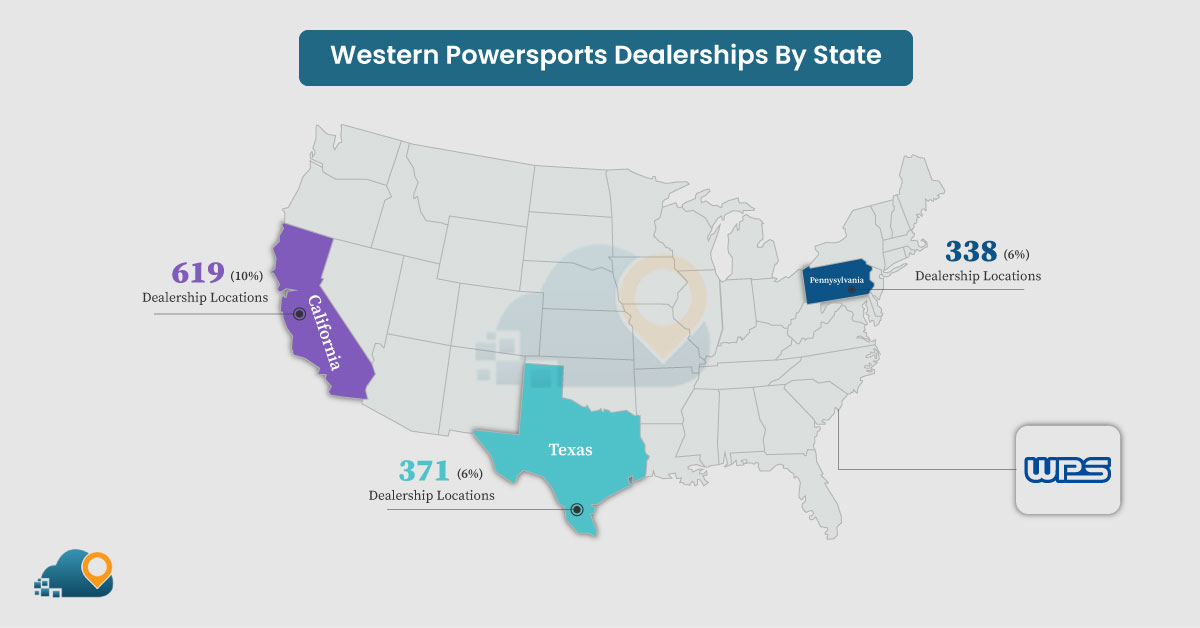

Western Powersports Dealerships By State:

California:

California leads with 619 Western Powersports dealerships, representing about 10% of the company’s total locations. Approximately one dealership for every 63,832 people in the state indicates a significant presence in a large market.

Texas:

Texas has 371 Western Powersports dealerships, accounting for 6% of the total. This translates to one dealership for every 78,156 residents, reflecting a strong but less concentrated presence compared to California.

Pennsylvania:

Pennsylvania also has 338 Western Powersports dealerships, making up 6% of the total. Pennsylvania has one dealership for every 37,876 people, showing a notable presence in a relatively smaller market compared to California.

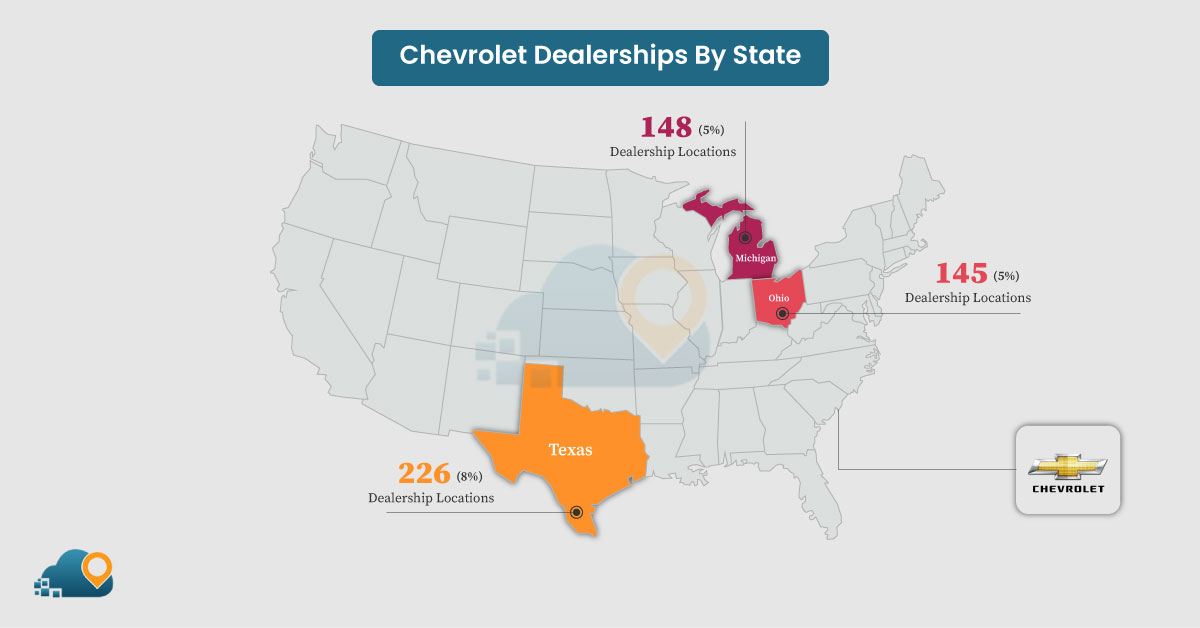

Chevrolet Dealerships By State:

Texas:

Chevrolet is represented in Texas by 226 dealerships, which is 8 percent of the total. The large state has a large market and dealership per 128 301 people, and while this is on the positive side, there appear to be fewer dealerships than in other states.

Michigan:

Michigan has 148 Chevrolet dealerships, constituting only 5% of the total. There is a dealership for every 67,480 people, which shows that this region has a higher concentration per population.

Ohio:

Chevrolet also has 145 stores in Ohio, which forms 5% of the stores in the United States. This means that for every population of 80,614 people, there is only one dealership, implying that these dealers are well-regarded within the state’s automobile market.

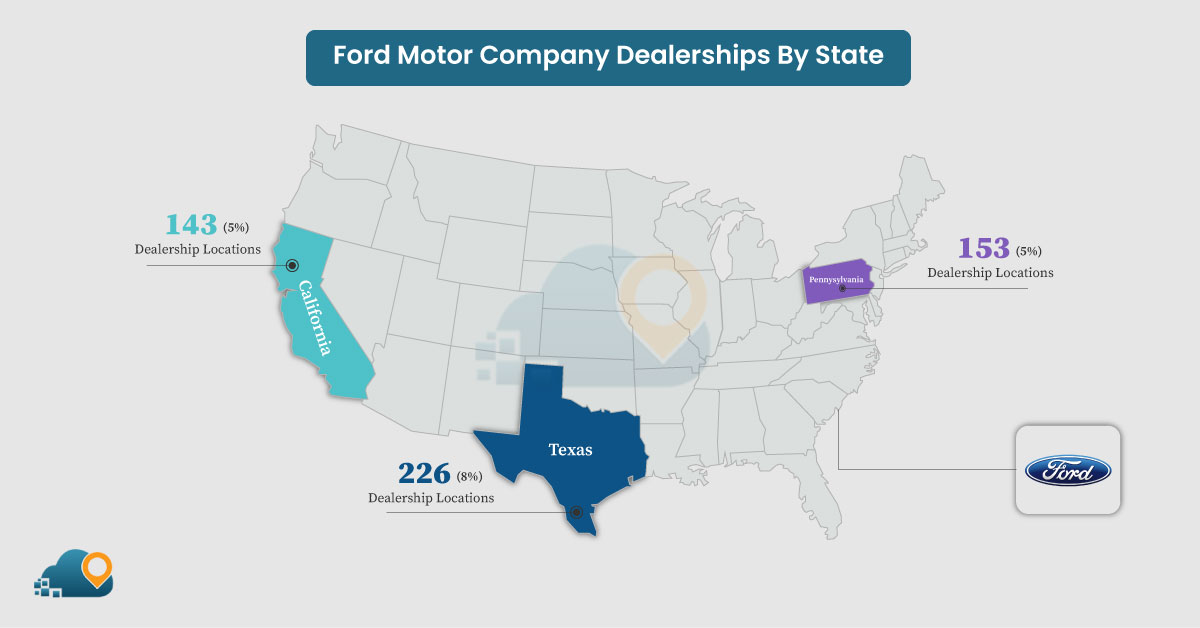

Ford Motor Company Dealerships By State:

Texas:

Texas currently has 226 Ford Motor Company dealerships, which is approximately 8% of the total. The ratio of dealers to population is high for the state; on average, there is one dealership for every 128,301 residents.

Pennsylvania:

Pennsylvania has 153 Ford Motor Company dealerships, constituting 5% of the total number. The regional density of the dealers is low, as there is one dealership for every 83,673 people, implying that the dealers are largely confined to the state.

California:

California hosts 143 Ford Motor Company dealerships, making up 5% of the total. This means that there is one location for every 276,308 residents. The density is lower compared to other states, which might be due to the large population and extensive market in the state.

Cities with the Most Number of Automobile Dealerships in the United States

1. Husqvarna Dealerships

In the United States of America, Husqvarna is a well-known manufacturer of motorcycles, lawnmowers, and other outdoor power goods with a large dealer network. Below are the dealerships offering products and services to customers seeking to obtain Husqvarna equipment.

Houston, Texas: 17 Locations

Being one of the biggest cities in Texas, Houston has a large demand for outdoor equipment and motorcycles which creates the necessity for having several dealers of Husqvarna motorcycles.

San Antonio, Texas: 16 Locations

As a large population city with emphasis for the outdoors, San Antonio has many Husqvarna dealerships.

Indianapolis, Indiana: 16 Locations

This city has a motorsport feel to it, which can be evidenced by the existence of the Indy 500, and therefore has a demand for Husqvarna products as well, having a high number of dealerships.

2. Tucker Powersports Dealerships

It is a leading distributor of motorcycle and powersport products in the United States. The dealerships listed below supply equipment, accessories, and services to the power sports industries in these areas. Let’s analyze the number of dealerships in specific cities across three states:

Miami, Florida: 50 Locations

There is heavy concentration of motorsports within Miami and this has led to several dealerships being opened within the city.

Phoenix, Arizona: 41 Locations

The setting of Phoenix is a desert area and the motorsport of off-road vehicle is famous there and thus the reason effects the number of Tucker Powersports dealerships.

Las Vegas, Nevada: 36 Locations

It has been noted that Las Vegas captures adventure tourism and given the huge off-road spaces nearby, it represents a solid market for powersport.

3. Western Powersports

It is a distributor of off-road and street motorcycle parts and accessories and has several dealers across the United States. The below-listed locations sell power sports segments and serve these markets with all the necessary power sports replacement parts and accessories. The below data highlights their presence in three cities:

Phoenix, Arizona: 26 Locations

With Arizona’s strong off-road and desert riding culture, Phoenix is a major hub for Western Powersports dealerships.

Houston, Texas: 24 Locations

As a large metropolitan area with a significant interest in motorsports, Houston supports numerous Western Powersports dealers.

Mesa, Arizona: 22 Locations

Like Phoenix, Mesa has a thriving outdoor and off-road activity scene, leading to a strong demand for Western Powersports products.

4. Chevrolet Dealerships

Houston, Texas: 8 Locations

Houston is a large city that needs many automobile dealers. Due to the high demand for Chevrolet cars, there are multiple dealers in Houston.

Indianapolis, Indiana: 6 Locations

The Indianapolis car town that accompanied the occasion of the Indy 500 automobile race also has a large number of Chevrolet dealers.

San Antonio, Texas: 4 Locations

Its four Chevrolet dealerships reflect San Antonio’s growing population and vehicle demand.

5. Ford Motor Company Dealerships

Houston, Texas: 8 Locations

Like Chevrolet, Ford has a strong presence in Houston due to the city’s large customer base.

Cincinnati, Ohio: 7 Locations

Cincinnati’s large metropolitan area and vehicle market support seven Ford dealerships.

Louisville, Kentucky: 6 Locations

As a regional economic center, Louisville has a solid demand for Ford vehicles, reflected in its six dealerships.

Conclusion

The automobile dealers companies are very important players in the consumption chain since they connect consumers directly with the producers. New car buyers depend on dealers for financing hence enabling them to be able to purchase cars easily. Therefore, the available industry research predicts a continued expansion of the nationwide dealership network for both authorized and independent dealers.

Through the optimization of consumer touchpoints, financial products, and distribution channels, automotive dealers can position themselves for demand and success in a post-pandemic environment.