As a smart businessperson in the United States of America, you know the importance of incorporating geographical information into your company’s strategies. The emphasis is made on its extensive chain of gasoline stations throughout the country. You can transform your business plans, improve your site selection, and access numerous other applications through integrated essential geospatial data. All these ideas are crucial in helping your business towards increased accomplishments.

To what extent can these insights be leveraged to your advantage? Now let’s focus on the geospatial structure of gas stations in the United States and take your business to the next level every single step of the way.

Quick Analysis of Gas Station Locations in the USA

LocationsCloud’s essential geospatial analysis of the USA’s gas stations reveals a remarkable statistic. There are approximately 196,643 retail gas station locations across the United States.

- Although the overall number of gas stations remains relatively high, large variations are still apparent across regions. Large cities often contain more stations that offer gas than areas that are sparsely populated.

- Texas, California, and Florida, which are large states, also boast the highest number of filling stations. This is due to their extensive road networks and large populations.

- The analysis carried out on geographic coordinates also found that most of the stations were located along interstate highways and busy roads, suggesting that location was critical relative to traffic density.

- Most strikingly, while the adoption of electric vehicles is ever-growing today, the number of gas stations has remained constant in the last ten years, indicating the continued use of gasoline.

- This is because most chains control the market share of gas stations, but there are stations that are independently owned and can serve customers’ specific preferences or regions.

- The main criteria for determining the location of stations include the density of traffic flow, the availability of site access, and proximity to large trading or populated areas.

- Furthermore, gas stations in the U.S. are not just places to refuel but multipurpose. Some of them provide subsidiary services such as shops, restaurants, and car repair agencies, among others, which makes them important service points in many areas.

- Geospatial data on gas stations is invaluable for consumers, logistics companies, real estate developers, city planners, and state officials, who rely on these insights for effective planning and decision-making.

10 Largest Gas Stations in the United States in 2024

In 2024, the landscape of gas stations in the United States will be dominated by several large chains, each with a significant presence across various states. Below is a detailed breakdown of the top 10 largest gas station chains in the U.S., ranked by the number of their locations.

AmeriGas

Total Locations: 50,838

Largest Presence: Texas, with 4,888 stations.

Percentage in Texas: About 10% of all AmeriGas locations.

AmeriGas is also the largest gas station chain in the United States, leaving its competitors far behind. It has over 50,000 locations, making it a dominant player compared to its rivals. The domination of the brand is highlighted by the fact that almost five thousand of its stations are present in Texas alone. Texas occupies approximately 10% of the total AmeriGas stores in the United States, proving the significance of the state for the firm. AmeriGas has numerous outlets, which makes it strive to be dominant in most states and territories, thus making it an option for fuel throughout the country.

Shell

Total Locations: 12,310

Largest Presence: Texas, with 1,532 stations.

Percentage in Texas: About 12% of all Shell locations.

Currently, Shell operates the second-largest chain of filling stations across the United States, with an outlet number exceeding 12,000. Like AmeriGas, Shell has conquered the Texans as over 1,500 stations are in Texas, constituting 12% of the total number of Shell’s stations across the USA. The market dominance of Shell in Texas is an impressive area that defines the state as one of significant importance to the development of the brand, as a result of which Shell became one of the most crucial gas station chains in the United States.

Exxon Mobil

Total Locations: 11,892

Largest Presence: Texas, with 1,964 stations.

Percentage in Texas: About 17% of all Exxon Mobil locations.

Exxon Mobil is third on the list of biggest gas station chains in the United States, with nearly 12,000 stations. Texas is the largest market for Exxon Mobil, as it owns almost 2,000 stations, contributing to about 17 percent of the company’s total number of stations in the United States. This high concentration level in Texas supports the argument that the state plays a strategic role in Exxon Mobil’s operations and business model, especially in the energy sector, where the firm has established a strong foothold.

BP

Total Locations: 7,111

Largest Presence: Wisconsin, with 676 stations.

Percentage in Wisconsin: About 10% of all BP locations.

BP is in fourth place among gas station chains in the United States and in over 7000 sites. Among all the states of the United States, Wisconsin occupies first place in terms of the number of BP stations located in it; there are 676 of them, which is 10% of all the stations in the United States network of BP Company. It makes sense that BP has a significant stake in Wisconsin as it takes up a substantial share of the national gas station.

Chevron

Total Locations: 7,021

Largest Presence: California, with 1,863 stations.

Percentage in California: About 27% of all Chevron locations.

Chevron, with just over 7,000 locations, is the fifth-largest gas station chain in the U.S. California is by far its most important market, with 1,863 stations, which accounts for approximately 27% of all Chevron locations in the country. This concentration in California highlights Chevron’s strong market position on the West Coast, where it is a leading fuel provider.

Circle K

Total Locations: 6,958

Largest Presence: Florida, with 945 stores.

Percentage in Florida: About 14% of all Circle K locations.

Circle K operates nearly 7,000 stores across the U.S., making it the sixth-largest chain. Florida is a crucial state for Circle K, with 945 locations, representing about 14% of its U.S. total. Circle K’s large footprint in Florida showcases its strong retail presence in this region, offering a wide range of convenience services and fuel.

ConocoPhillips

Total Locations: 6,098

Largest Presence: California, with 864 stations.

Percentage in California: About 14% of all ConocoPhillips locations.

ConocoPhillips has over 6,000 gas stations across the U.S., making it the seventh-largest chain. California has the most ConocoPhillips stations, with 864 locations, about 14% of its total U.S. presence. ConocoPhillips’s significant presence in California reflects its strong focus on this crucial market.

Citgo

Total Locations: 4,309

Largest Presence: North Carolina, with 394 stations.

Percentage in North Carolina: About 9% of all Citgo locations.

Citgo operates more than 4,300 gas stations in the U.S., ranking as the eighth-largest chain. North Carolina has the most Citgo stations, with 394 locations, which represents about 9% of Citgo’s total U.S. network. Citgo’s strong presence in North Carolina indicates its strategic focus on this region.

Speedway

Total Locations: 3,233

Largest Presence: Ohio, with 462 stations.

Percentage in Ohio: About 14% of all Speedway locations.

Speedway has over 3,200 gas stations across the U.S., making it the ninth-largest chain. Ohio is a crucial market for Speedway, with 462 locations, which is about 14% of its total U.S. network. This strong presence in Ohio reflects Speedway’s roots and continued focus on this region.

Phillips

Total Locations: 2,548

Largest Presence: Missouri, with 544 stations.

Percentage in Missouri: About 21% of all Phillips 66 locations.

Phillips 66 rounds out the top 10, with 2,548 gas stations in the U.S. Missouri has the highest concentration of Phillips 66 stations, with 544 locations, representing about 21% of its total U.S. footprint. This significant presence in Missouri highlights the brand’s focus on the Midwest region.

These 10 gas station chains dominate the U.S. market, with AmeriGas leading by a large margin. Texas, California, and Ohio emerge as key states for multiple brands, reflecting their importance in the overall U.S. gas station landscape. Each brand has strategically concentrated its operations in specific states, contributing to its overall market strength.

Distribution of U.S Gas Stations by States

It is important to analyse the location distribution of gas station in the different states of USA.

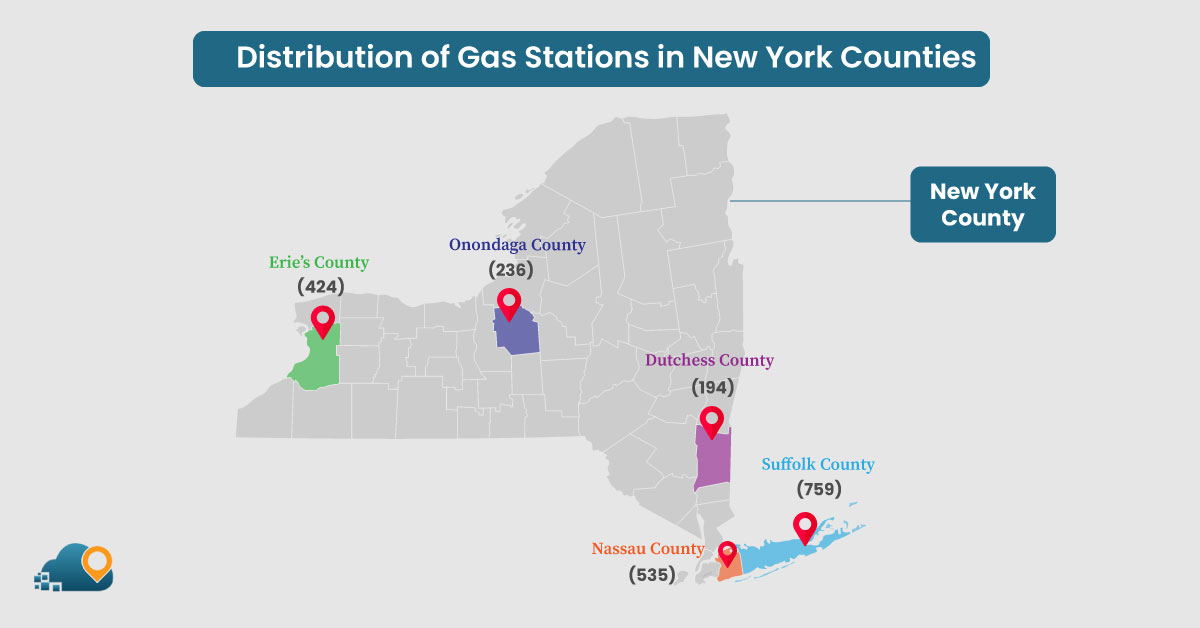

Distribution of Gas Stations in New York Counties:

Suffolk County has the largest number of gas stations, with 759 stations in total. This might be due to its vast size, higher density of vehicle ownership, and higher consumption rate in proportion to other factors that indicate that the county has substantial mobility requirements.

Nassau County is the second largest, with 535 and Westchester has 435 service stations. The existence of many full-service and self-serve gas stations points to the high car usage in these countries, probably due to the high population and commuter traffic, mainly in New York.

Erie’s 424 service stations enable it to serve as the hub county of Buffalo, one of the region’s most populous cities. Queens County has 369 stations, Monroe County includes Rochester and has 315 stations, and Kings County is Brooklyn has 280 societies. As to the reduction of the number of gas stations in these areas, they should consider population density, urbanization, and accessibility to public transport. For instance, Queens and Kings, part of New York City, can have fewer cars on the road because of the efficient public transport, which leads to fewer gas stations.

Onondaga County, which contains Syracuse, has 236 gas stations. Orange County is also moderate and has 221 gas stations. Its population is in the mid-level, and it is relatively urban.

Dutchess County has 194 gas stations, and Bronx County has 180. Albany (the state capital) has the highest number of outlets at 151, followed by Saratoga with 149 and then Broome at 147. Despite these comparatively low numbers, the populations in these counties may be smaller, with fewer people in densely populated urban areas or relying more on other means of conveyance.

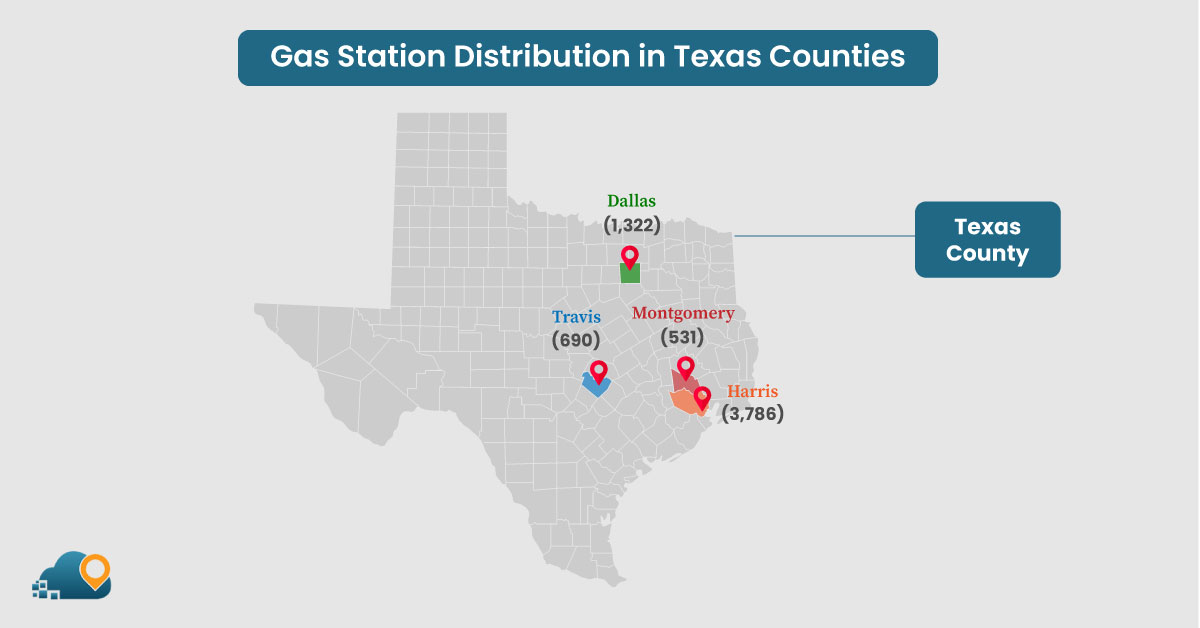

Gas Station Distribution in Texas Counties:

The gas stations are relatively high, with Harris County reporting the highest number of 3,786, the highest in any county in Texas. This dominance is most probably because Harris County contains Houston, the largest city in Texas and perhaps the most developed in the entire South. There is a large population and traffic congestion, high car usage, and a vast area occupied by Houston city.

The next largest number of gas stations is in Dallas County, with 1,322; Tarrant County, which is home to Fort Worth, has 1,213 and Bexar County, home to San Antonio, has 1,152. These numbers depict that fuel is needed in these populated urban cities with many stretches of roads and many people going to work and other places daily.

In Travis County, where Austin is situated, there are 690 gas stations. The few assumptions supporting the slightly lower figure include fewer people in those counties, urban development could be more efficient, and there may be improved public transport, hence less car use.

There are 532 gas stations in Montgomery County and 531 in Hidalgo County. These figures indicate that these counties need considerable but somewhat less fuel, perhaps because of their population or the fact that not all of them are urbanized like the Harris or Dallas counties.

Gas Station Distribution in California Counties:

Los Angeles County: 2,704 Gas Stations

Overview: Among all the counties, Los Angeles has the most service stations, with 2,704 stations. The large number is because it is one of the country’s key urban and economically vital cities. It is also densely populated, has numerous freeways, and residents largely rely on cars, which means there is a need for many gas stations.

San Diego County: 906 Gas Stations

San Diego County has the second-highest number of gas stations, with 906 locations. This is true because it is one of the prominent metropolitan cities in the world where the majority of the working population uses automobiles as their major means of transport.

San Bernardino County: 853 Gas Stations

San Bernardino County follows with 853 gas stations. Known for its large geographic area that includes both urban and rural regions, this county strongly needs gas stations to support long commutes and extensive travel distances.

Orange County: 828 Gas Stations

Orange County has 828 gas stations. This county is characterized by its extensive suburban developments and high level of car dependency, which creates a consistent fuel demand.

Riverside County: 718 Gas Stations

Riverside County has 718 gas stations, which points to the region’s suburban characteristics and car-oriented transportation. As in any other southern California neighbor county, the population depends heavily on automobiles.

Central and Northern California’s Moderate Counts

Kern County: 522 Gas Stations

Kern County, located in Central California, has 522 gas stations. The county’s mix of rural and urban areas and smaller populations compared to Southern California result in fewer gas stations.

Fresno County: 484 Gas Stations

Fresno County, also in Central California, has 484 gas stations. This county is more agricultural and less urbanized than the Southern California regions, leading to a lower number of gas stations.

Distribution of Gas Station by Pricing

Moderately Priced Gas Stations:

The most numerous group, comprising 25,872 sites, is the group of sites with moderate average daily spending. This shows that most fuel retailers appear to price their fuels at moderate price competition strategies because they want to be able to charge reasonable prices to their consumers and make good profits. By being located in this grey area, such stations can attract all sorts of customers, and while their prices are relatively reasonable, they can still make a healthy profit.

Inexpensive Gas Stations:

Out of the total number of stations, 13,203 are categorized as low-priced. This large number can be attributed to a strategic move adopted by some retail businesses in their quest to attract low-end, price-sensitive consumers. These stations might emphasize on providing lower prices as their competitive advantage to customers while noting other factors, such as the costs of various commodities.

How LocationsCloud Data Assist in Improving Business Outlook?

LocationsCloud has accurate, fresh, and comprehensive data, thus enabling these businesses to make significant decisions and preventing costly mistakes. The scale-up capability of data is very enthralling, making it possible for organizations of all sizes to perform. Their intelligent analytical capacity enables organizations to develop a forecast that can be very useful during planning. Therefore, with the help of LocationsCloud’s data, it is possible to introduce practical solutions or fresh approaches to remain informed and react to all the changes, which may positively affect the enterprises’ tendencies and, thus, their future.

Conclusion

In the fast-growing business world, the information provided by LocationsCloud about the distribution of gas stations in the USA can be crucial for companies to gain a competitive advantage. Those who can harness this data in the best way possible can be sure to select better sites, make better decisions, and work better. As this guide implies, these insights should be applied strategically to apply high technology where accuracy matters, focus on high-value service offerings, and seek professional