In this day and age of fierce competition and data-informed settings, retail banks continuously develop new ways to improve customer interactions, make their processes more efficient, and make more money. Location Intelligence has revolutionized the finance and banking sector. Retail banks can unlock tremendous potential by utilizing location data to make data-driven decisions. That empowers them to significantly enhance engaging customers, streamline operations, and drive strategic growth. By leveraging location data, retail banks can stay ahead of the competition and deliver unparalleled value to their customers. This article will discuss how five ways of location intelligence for banking empower retail banks, using real-life cases to show how it can change things.

What Does “Location Intelligence” Mean?

Location Intelligence is a powerful method for getting helpful information from location-based data. It uses cutting-edge geographic information systems (GIS), advanced data analytics, and comprehensive visualization tools. Making use of location intelligence in retail banking requires the use of POI (Points of Interest) or geographic data to make wise decisions that promote the growth of business, improve customer relationships, and streamline operations.

For this method to work, data related to specific geographic points must be collected, looked at, and interpreted. The data can include a lot of different kinds of information, like demographics, patterns of customer behavior, economic indicators, and even competitors’ locations. Location Intelligence for banking can uncover hidden patterns and tendencies in data by mapping and analyzing it spatially. This approach can reveal insights that may need to be apparent using traditional data analysis methods.

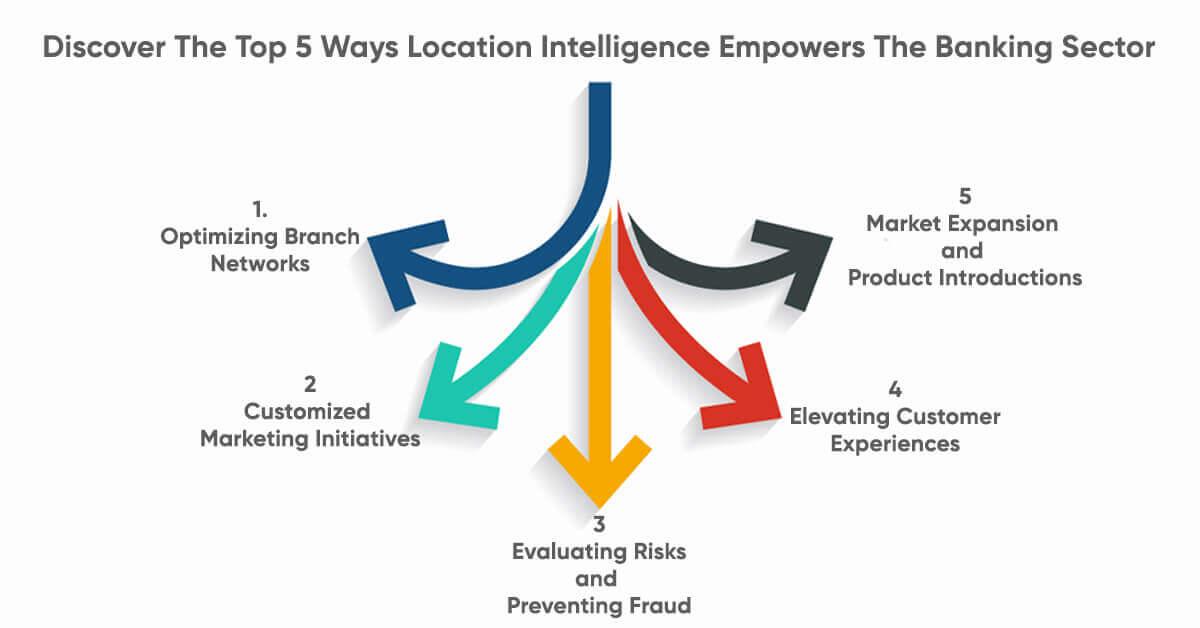

Top 5 Ways Location Intelligence Empowers The Banking Sector

Want to know how location intelligence is transforming banking sector? Here are the top 5 ways it empowers smarter, data-driven decisions and gives retail banks a competitive edge.

1. Optimizing Branch Networks

Banks need to put their branches in essential places so that customers can quickly get to them and the business runs smoothly. It gives banks the data to make intelligent decisions about their branch networks through Location Intelligence. Banks can find the best places to open new branches or see how well current ones are doing by looking at transaction patterns and demographic data. Banks can improve their services and make sure their branches are in easy-to-reach places by using location data to figure out how customers act. This optimization not only cuts costs but also makes it easier for customers to get services, which makes them happy. Also, banks can quickly change their services and staffing levels to meet the new needs of their customers. Finally, using Location Intelligence to make branch networks better ensures that banking services are placed strategically and can change to meet the needs of their areas.

2. Customized Marketing Initiatives

Based on their customers’ location data, retail banks can use Location Intelligence to learn much about what they like. In turn, that lets them make more targeted marketing campaigns. Customers are more likely to interact with a business if it focuses on specific places or branches. Customers’ real-time feedback helps banks quickly change how they market themselves. That ensures that their campaigns are always helpful and meet the wants of their customers. That gives you more options, which makes your investment pay off and keeps customers coming back to your brand.

3. Evaluating Risks and Preventing Fraud

Location data can help banks find and stop fraudulent activities. Location Intelligence lets the process happen by checking transaction sites against customer data to see strange patterns. That way, banks can move quickly to stop fraud, protect their assets, and earn the trust of their customers. Location Intelligence is also helpful for handling risks before they happen. Location data lets banks figure out how risky different places and branches are. Banks can use this knowledge to tighten security, teach customers about possible risks, and put fraud detection systems where needed most. This method helps to keep the bank’s image safe, cut down on losses, and keep customers’ assets safe.

4. Elevating Customer Experiences

Retail Banks help their customers by using Location Intelligence. Location data helps banks figure out when they’ll be busy so they can make sure they have enough staff to keep wait times as short as possible. Also, banks can give services based on where the customer is, such as showing them ATMs or branches close by. That makes location information for banking more accessible for customers and more beneficial for them. Not only does location intelligence make operations more efficient, but it also changes how banks talk to their users. For example, geolocation features in mobile banking apps let users get information based on where they are, like special offers, closed branches, or ATMs. Notifications in real time about sales or deals happening nearby get customers involved and make banking services more personalized and easier to use.

5. Market Expansion and Product Introductions

Location data can help banks find new places where they can grow. Banks can use this data to decide whether to open more branches or provide new goods and services in certain areas. This method makes sure it uses resources well, which boosts earnings and market share. Location Intelligence helps banks grow by joining new markets because it helps them learn more about the local economy. Banks can find places where people are making more money, the population is growing, and customer wants are rising. Banks can use this information to ensure that their new and current products and services meet the needs of these markets. For instance, banks can help growth over the long term by putting out mortgage goods in places where there are a lot of new homes or small business loans in areas where there are a lot of new businesses.

Final Thoughts

Location Intelligence changes the banking industry by using location data to give helpful information. Banks can stay ahead of the competition by improving customer experiences, assessing risks, expanding their markets, and making office networks operationally more efficient. Today, any forward-thinking retail bank that wants to keep growing and keep customers happy must use Location Intelligence for banking. Fundamentally, Location Intelligence is the guide that points the banking industry toward higher efficiency, better customer experiences, and more intelligent decisions. To make sure their services stay current, safe, and focused on customers, banks can confidently navigate the complicated world of finance by using location data. Adopting Location Intelligence will be very important for retail banks that want to stay ahead of the game and give their customers great value as technology improves.

Working with technical solutions can speed up the process for retail banks that want to use location intelligence to its full potential. LocationsCloud is a well-known company that provides Points of Interest (POI) data. Discover how LocationsCloud can assist your bank in making the most of location data with solutions customized to the finance and banking industry.